By: Divya Siddarth and Steven McKie (Note: This was originally published on the Amentum Capital newsletter, and was published here with permission.)

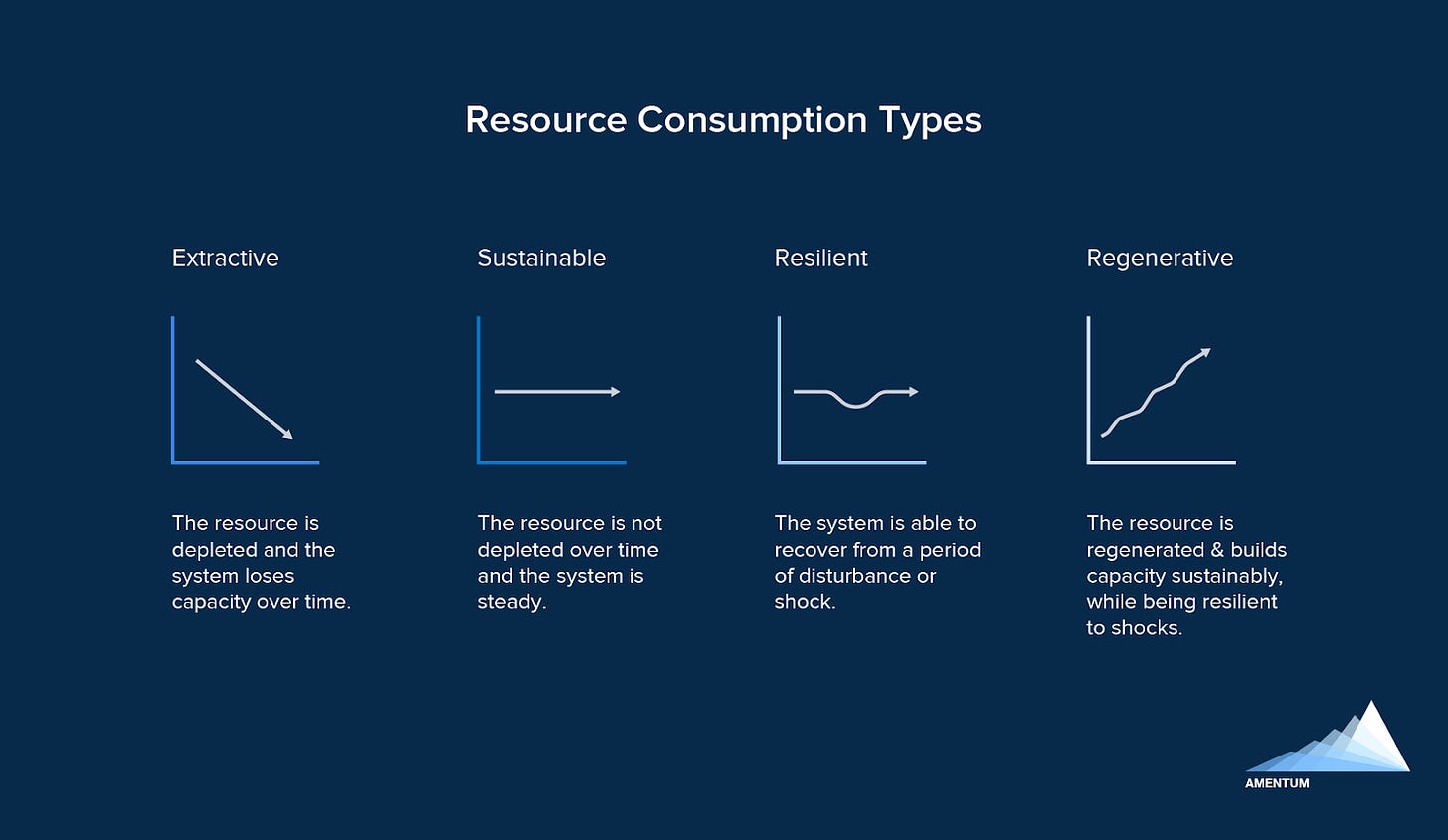

It can often seem like the crypto ecosystem is predicated upon an idea of infinite wealth through speculation. Real world resources, by contrast, seem like finite things connected to real needs. Neither is quite true. There are limits to speculation. And the limits that finite resources seem to place on meeting real needs can be overcome with an ethos of regeneration, rather than extraction.

Regeneration leaves resources intact, or replenishes them with use such that they do not deplete over time. Rather than externalizing its true costs, regeneration incorporates and overcomes the cost of resource use through resource generation. Regenerative approaches are based on cooperation, recognizing that zero sum games leave all worse-off. But they leave space for competition, when it allows for choice and does not involve the reproduction of unnecessary costs and can lead to the creation of shared benefit.

Extractive models use up and degrade resources, so that they cannot be re-used or replenished. Extractive systems often see resources being accrued by those who had resources to start with, because it is those people who have the ability to continuously extract. They consume a set of resources and then move on to extract from another space, leaving devastation in their wake, by centralizing power in an economy of scale.

The crypto ecosystem has a choice: the path of regeneration, or the path of extraction. Extraction can create infinite digital wealth for some, it’s true. But regeneration can create sustainable physical well-being and security for the many.

Choosing Regeneration

Taking the path of regeneration means learning from regenerative practices that already exist: Indigenous practices of land stewardship, community and commons-based governance, the principles of regenerative growth and agriculture.

For example, strategies like intercropping involve planting sets of crops that complement each other’s growth - a classic example being corn, beans, and squash, known as the Three Sisters. Beans add nitrogen to the soil and squash vines maintain soil moisture and prevent weeds, both aiding in the growth of corn stalks, which in turn can act as a natural trellis on which the beans and squash can grow. Similar approaches are used on a more macro scale, in the cultivation of trees, crops, and animals together in ways that benefit all three - enabling collective flourishing through complex interactions between the effect of each on soil, shade, habitat, water. And, zooming out even more, driven by an understanding that depleting the commons means depleting a valuable and shared asset that many benefit from, and will continue to benefit from into the future.

Meanwhile, the enclosure of the commons is a continuous process of extraction - and one that has reproduced itself in the digital sphere. Everything from publicly funded knowledge and innovation, to the public domain of creative works and digital art, have become commercialized and privatized, with ordinary citizens cut off from benefitting. The greatest strengths of the crypto ecosystem come from creating meaningfully different structures of voice and ownership; structures that allow for communities to participate in resource preservation and growth. It is possible to use new political and economic formulations to return to the intentional interdependence and collective governance that is required to build regenerative systems. The networked reality of our current world may seem far from the simple interdependence of growing the Three Sisters, but these fundamental principles can still hold.

Commons have been portrayed as antiquated and doomed to failure - many more people have heard the phrase ‘tragedy of the commons’ than have been exposed to the successes of commons governance across use cases. However, in reality, We need approaches that are collective, regenerative, and commons-oriented. Instead of castles in the digital sky, we can plant roots in the multi-modal ground - and create a foundation for the castles to come.

The Energy Commons

Regeneration is a philosophical stance, certainly, but it is also a practical one. Choosing a regenerative ecosystem will require hundreds of thousands of choices, made by hundreds of thousands of individuals and communities. In the blockchain ecosystem, this means that projects will have to actively and broadly think about the resources that are being depleted, and then replenish and sustain them.

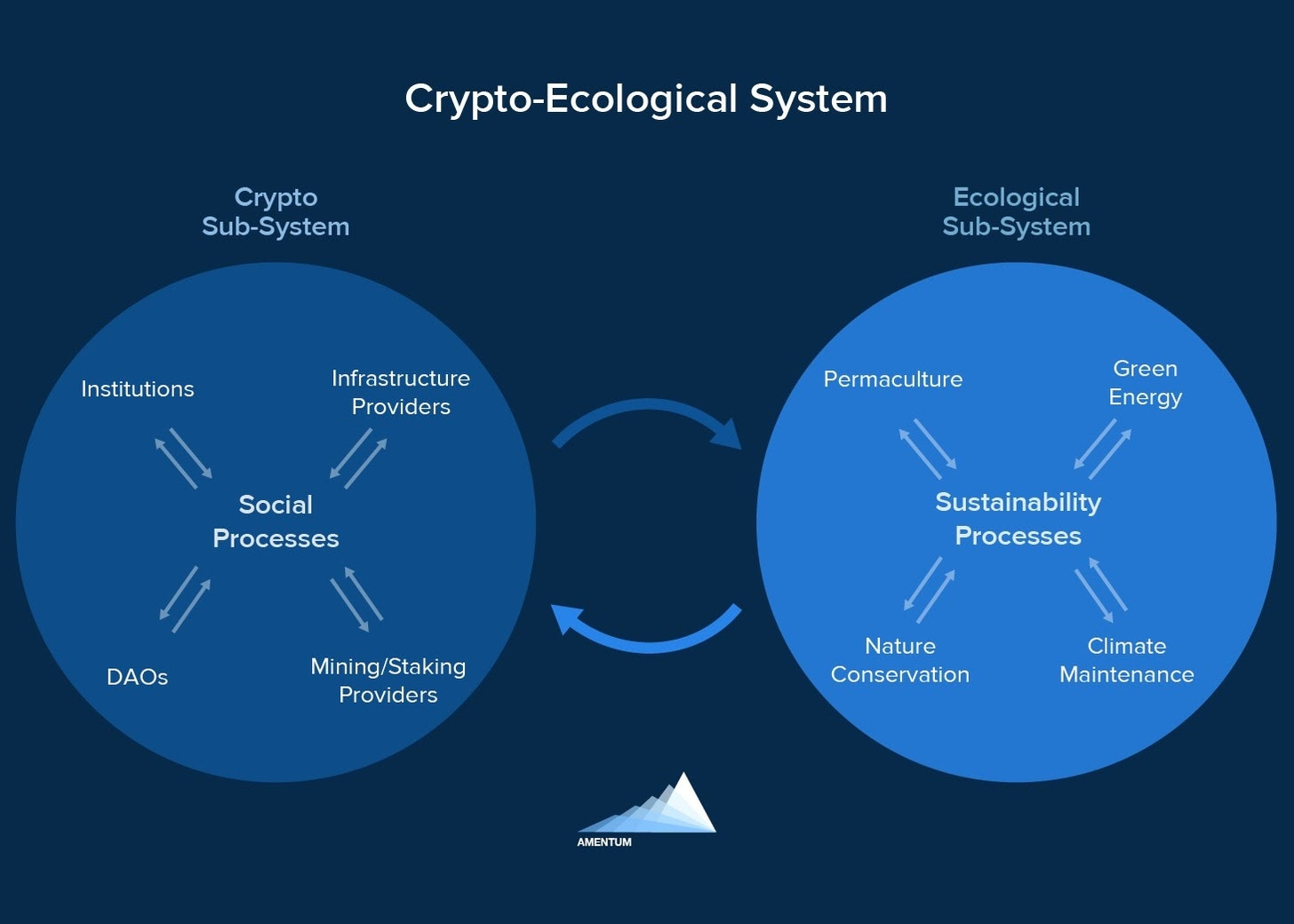

There are two important and overlapping ways to choose regeneration in the crypto ecosystem. The first is to look at the ecosystem itself, and ensure that projects within this ecosystem take a collective, regenerative, and commons-oriented approach to both the digital and physical resources that they use - internal public goods, as well as time, attention, financial resources, energy. And on a second order, that the systems they engender are themselves regenerative, moving from extractive, financialized and individual profit-focused models to collective and community-oriented models. The second is to use the affordances of crypto - ownership, voice, incentives - and try to build solutions using these systems to expand and deepen collective, regenerative, and commons-oriented approaches in currently extractive industries, or around currently fast-depleting resources. Many efforts that we find particularly inspiring - DisCO, the Commons Stack, the Regen Network, and others, combine these approaches; some, like Gitcoin, fall largely into the first, others, like recent DAO land trusts, fall largely into the second.

Here, we will try to practically explore what the second approach could look like. And for good measure, we’ll focus on a resource that is relevant to the first approach as well, as it is one that the crypto ecosystem has been accused, and often rightly so, of squandering: energy.

The energy we use to power our lives is a fundamental physical resource: we all need it. It is also a technologically mediated one: a vast machinery exists to route energy from power plants to your outlets, with tens of intermediaries along the way. It necessarily involves public and state-funded infrastructure, as well as private infrastructure and local oversight, and it is likely to be significantly disrupted by climate change, which it also massively contributes to.

In short, it’s an incredibly complex system of production and provision, it is mediated in different ways by software, hardware, and institutions, and it’s central to almost everything we do (sounds like the financial system, right?). And while there’s broad agreement that something needs to change, between grid failures (Texas, California) and contributions to global warming (particularly in the Global North: 25% of US greenhouse gas emissions come from electricity production), both entrenched interests and meaningfully complex technical issues have stymied radical development. Neither of us are long-term experts in energy infrastructure. But I think we can all recognize that if there was ever a space that needed updated and technically-enabled accountability mechanisms, new incentive structures for both global coordination and local oversight and ownership, and a broader understanding of interdependence and collective flourishing, it’s energy. And if there’s a technology that at least promises to build the foundations of some of those mechanisms, it’s crypto.

First steps to approaching energy

There are clear steps towards building resilient energy infrastructure that can be tackled without needing to wade into finding the perfect, nation-specific and region-specific policy solutions for power generation. The first of these is: distribute the ability to produce, use, and transact renewable energy to more communities, and build local resilience in energy infrastructure.

The first challenge is, as often, is skewed financial incentives. The financial benefits of electricity generation tend to be centralized, concentrated in the hands of shareholders and executives. This is a complicated problem to solve. Multiple players need to be involved: public utilities, rural cooperatives, regulated monopolies, etc. There is no one-ownership-model-fits-all solution here: nationalized grids are the answer in some cases, community-owned utilities in others, and likely a layered system that allows for more distributed control will combine the two. For instance, region-specific needs rule the day - the grid ecosystem in India bears very little resemblance to the grid ecosystem in the US. Policymakers have much to consider here.

There is also a second set of problems. How much energy to produce, and how? Given the entrenched interests in the space, it is no surprise that energy companies often lobby directly against sustainable energy and less fossil fuel consumption - even while publicly supporting climate change resilience. Even without this lobbying, the political will to transition national energy grids to sustainable energy is lacking, due to a misalignment of incentives. Instead, corporations and captured government officials in the space pay lip service to individual habit changes and so-called environmentally friendly company practices (read about the scam of ESG metrics from this BlackRock investor) to put off the inevitable: our infrastructure is not ready for climate change, and it is the most vulnerable communities who will be hit first.

In short, this is a complex, regionally-driven space with entrenched interests and no clear answers. So...how will crypto solve energy?

The answer is: it won’t. Our hope in gesturing at the complex and emergent nature of this system is to complicate this picture. The careful balance necessary for regeneration is clearly not in play in this extractive industry. However, another shock is unlikely to create it. Instead, a successful collective, regenerative, and commons-based approach needs to start small - taking the breadth of this ecosystem into account and zooming in on where the affordances of crypto can really make an impact.

Sure, crypto-based approaches cannot solve the slow crumbling of our public infrastructure, or the major imbalances in power consumption between the Global North and the Global South. But they can do something better: plant the seeds of small-scale changes that can have significant ripple effects, pointing the way towards a more resilient ecosystem. This comes from focusing on specifics.

We can start by recognizing that two things need to happen. One, our energy generation systems need to become climate resilient and sustainable - and this needs to move far, far more quickly than it is today (partly due to investor-owned utility monopolies lobbying desperately against clean energy). And two, we want a “small-d” democratic system, that distributes economic and social power more broadly and allows for communities to access reasonably-priced electricity when they need it. Increasing the use of solar energy through local generation tackles the first need, distributing the ability to produce, use, and share power begins to outline a democratic way to do it.

Green Shoots

Now we’ve reached a specific need that cryptoeconomic affordances can support. And our evidence is that they already are - albeit in small, and still-nascent ways.

One such example is facilitating resilient community micro-grids, potentially building out a network of foundational infrastructure to power regenerative agriculture, seed-saving, and community food projects. In fact, it’s this solution that brought the authors together - one having explored decentralized solar grids in Bangladesh, and the other having just invested in DexGrid, a company that aims to use crypto to facilitate decentralized energy transactions in Puerto Rico.

The key is to start with communities that aren’t being served well by existing grid infrastructure. In a country wracked by hurricanes, where people have become accustomed to not being served by the central grid, there is a desire for control over one’s power source. Thus, many small businesses and family homes had already found ways to supplement or bypass the central energy infrastructure, cutting off the connective wires and instead installing roof solar panels or acquiring energy through other means. But while these individual solutions provided some relief, they came with a major cost: unreliable power.

DexGrid provides an intuitive solution: enabling communities to tie together their solar setups into community micro-grids, incentivizing those with greater energy needs (such as local manufacturers) to act as ‘anchors’, building additional collection and storage facilities to ensure that power needs are reliably met. Resilience in this model is inbuilt. Relying on local resources protects communities from major outages, and ties communities closer together. Cryptoeconomic incentives allow for families and small businesses to target their usage habits towards non-surge energy use, self-regulating the micro-grid away from surging prices. This interdependence is a useful technical redundancy, meaning that power can always be drawn from multiple sources with no single point of failure, and a move towards a more commons-based and regenerative approach to power generation.

It is important to note that it is not only natural disasters that create regions that don’t have control or access to grid resources. Simple distance from the grid can create inaccessibility, as was the case with the decentralized solar grids that one author studied in Bangladesh. So can public underinvestment and neglect, as was the case in New York’s Lower East Side in the 1960s and 1970s, which led to community-based movements converting abandoned lots and burned-out buildings into self-sustaining and food-producing community gardens - many of which still exist, and are now powered by small-scale solar grids. NYC has actually also been a pioneer of community-owned micro-grids, with Brooklyn Microgrid building an energy marketplace for locally-generated, solar energy. This is only a quick overview of one slice of regenerative technology, but as these small-scale projects spore outwards and proliferate, they can create new models of regenerative growth.

The Path Forward

Decentralized technology does not mean decentralized power.

This simple insight cuts through the promises of many a so-called decentralized protocol, platform, or project. Without directly addressing power concentration, the default is to reproduce imbalanced power structures.

In a prior essay, Steven McKie discussed a set of mechanisms through which crypto-economists can balance the creation of machine economies and natural conservation and growth. This method of green engineering can create regenerative feedback loops that allow self-sustaining flywheels to emerge, geared towards non-extractive modes of value generation. This essay begins to catalogue some of the efforts within crypto that are taking a regenerative approach.

We are laboring under an inability to imagine alternatives to our existing systems, but such alternatives are possible. The beauty of the crypto ecosystem at its best is that it gives us the space and the tools to imagine and build such alternatives. We cannot immediately build an end-to-end new world; nor should we.Such top-down experiments in utopia have a history of failure. Instead, what we can do is build more democratic, egalitarian, and participatory spaces and modes of interaction wherever there is open space, and then work to expand that space over time. This requires not only choosing regeneration, but also choosing the mechanisms to target within existing systems that can be made regenerative, expanding and building coalitions across these to eventually grow regenerative practices in both digital and physical space.